Because it is not a mere Greek issue but a pan-European one and it is not a financial or even economic issue but one of democracy and sovereignty.

But there is also a Greek facet and a financial facet to all it.

Exposure

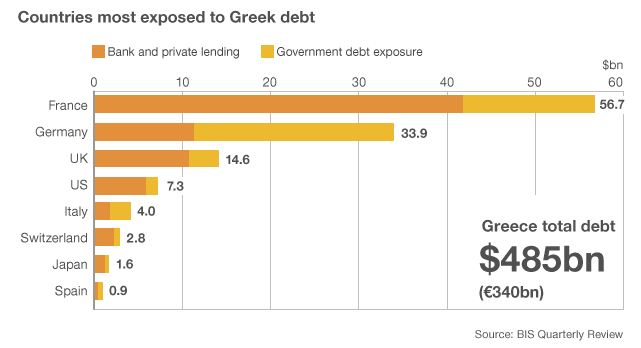

Naked Capitalism offers us this graph (originally from BBC, it seems):

The graph is consistent with the data published by the BIS months ago plus the first rescue package (that explains the large German public exposure) but hide the main exposed country: Greece itself.

It is not consistent however with the data provided by The Guardian, which states that the French exposure is of "only" € 9.4 billion, the German one of € 7.9 billion and the Greek one of € 45.9 billion. Other exposed states are the Netherlands and Belgium (together € 7.2 billion), Cyprus (as much as € 5.9 billion), the UK (€ 2.1 billion), Portugal (€ 1.3 billion) and Italy (€ 1.2 billion). This data seems to refer to exposure of private banks only but is still not coincident with the BBC figures above (total is "only" € 91.8 billion) .

In any case, The Guardian's data has the advantage of listing the allegedly most exposed banks:

- NBG (Greece): € 19.4 billion

- Agricultural Bank (Greece): € 10 billion

- Piraeus (Greece): € 8.7 billion

- EFG Eurobank (Greece): € 7.9 billion

- Hellenic Postbank (Greece): € 5.4 billion

- BNP Paribas (France): € 5.0 billion

- Alpha Bank (Greece): € 4.6 billion

- Dexia (Belgium): € 3.5 billion

- Marfin Popular (Cyprus/Greece): € 2.9 billion

- Komerzbank (Germany): € 2.9 billion

- Societé Generále (France): € 2.5 billion

- ING (Netherlands): € 2.4 billion

- Bank of Cyprus: € 2.0 billion

- Landesbank Baden (Germany): € 1.4 billion

- Postbank (Germany): € 1.2 billion

- DZ Bank (Germany): € 1.2 billion

- BPCE (Germany): € 1.2 billion

- Bank of Scotland (UK): € 1.1 billion

Who should exit the Eurozone?

Oddly enough a column at the conservative British newspaper The Telegraph suggests that it is not Greece who should exit but Germany. According to Edmund Conway:

Without Germany, the euro would obviously be a significantly weaker currency (particularly if Germany was joined by the Netherlands). But it would no longer be torn apart by the unhealthy dynamics that have haunted it in its first decade.

True, very true. However Germany would lose much of its internal competitive advantage within the EU and for that reason alone, Germany will not exit the euro, not even if the other states impose a more flexible monetary policy devaluing the currency. Germany is just too dependent on its sales to other EU states to allow itself losing such neocolonial markets. What they will do instead is to try to keep the euro policies as fascist as they have been so far, and that is what is causing all this havoc.

So the Eurozone will unavoidably collapse because for Germany it is easier to let the neocolonies go away one by one, weakened by immense debt and social collapse, than allow them to take control of the European Union. Technically the southern states, specially if supported by France, could take complete control of the Union and force the hand of Germany but for that they would need to have compromised leaders who were not sold to foreign "investors", who really cared about their countries future. These do not seem to exist in most cases and that's why the peoples in all the southern European Union are so upset at their leaders and political systems.

No comments:

Post a Comment

Please, be reasonably respectful when making comments. I do not tolerate in particular sexism, racism nor homophobia. The author reserves the right to delete any abusive comment.

Comment moderation before publishing is... ON